Unlock Your Wealth: Real Estate Crowdfunding Tips

Real estate crowdfunding has become a popular way for individuals to invest in real estate without the hassle of managing properties themselves. By pooling funds with other investors, individuals can access a wider range of investment opportunities and potentially earn higher returns. However, like any investment strategy, success in real estate crowdfunding requires careful planning and consideration. Here are some tips to help you maximize your investment success with real estate crowdfunding:

1. Do Your Research: Before diving into real estate crowdfunding, it’s important to do your homework. Research different crowdfunding platforms, investment opportunities, and the real estate market in general. Understand the risks and rewards associated with real estate crowdfunding and make sure it aligns with your investment goals.

2. Diversify Your Portfolio: Diversification is key to reducing risk in any investment portfolio. With real estate crowdfunding, you have the opportunity to invest in a variety of properties across different locations and asset classes. By spreading your investments across multiple properties, you can minimize the impact of any one property underperforming.

3. Set Realistic Expectations: While real estate crowdfunding can offer attractive returns, it’s important to set realistic expectations. Understand that real estate investments are long-term endeavors and that returns can fluctuate based on market conditions. Don’t expect to get rich quick, but rather focus on steady, long-term growth.

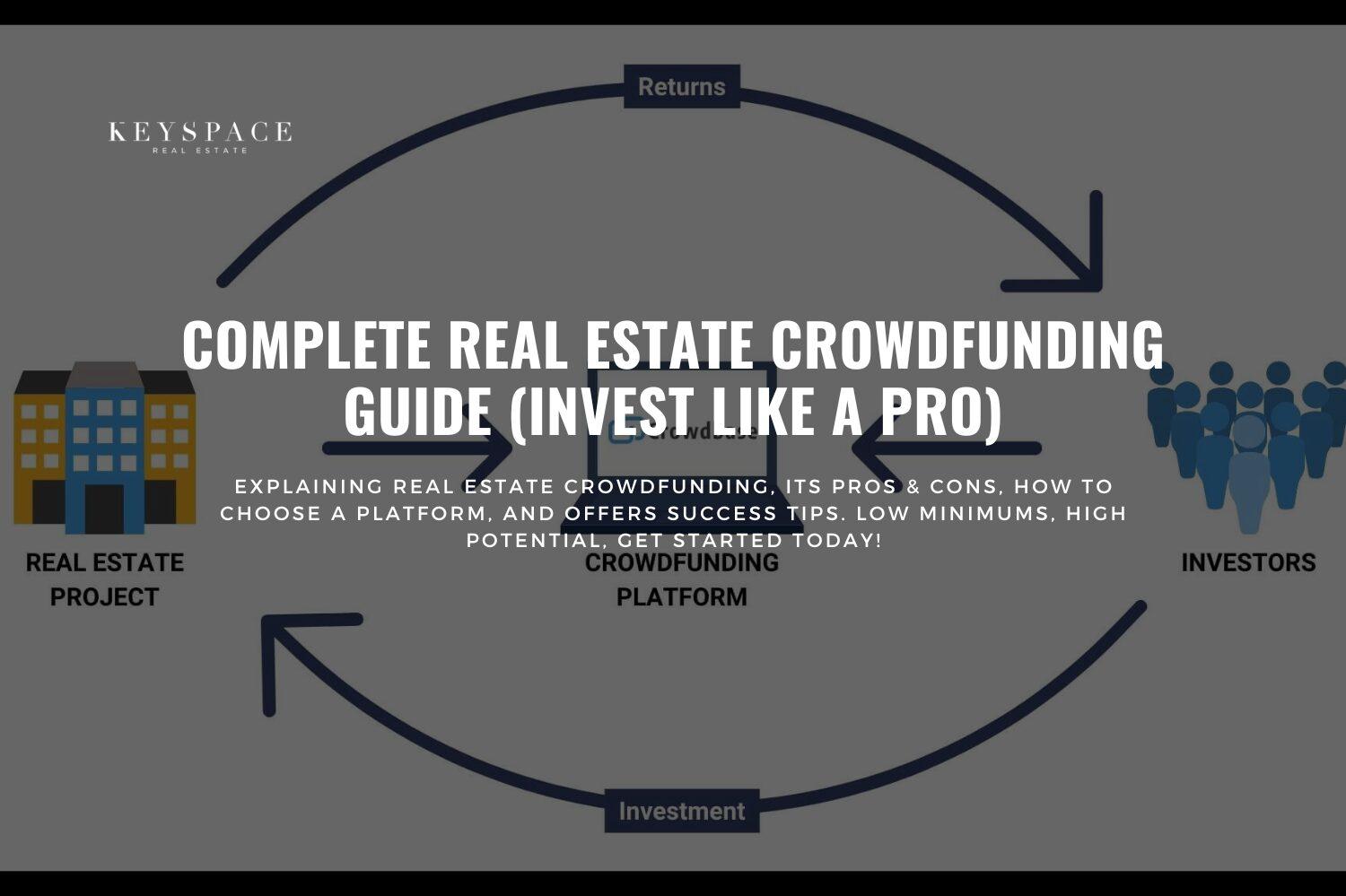

Image Source: keyspacerealty.com

4. Evaluate the Sponsor: The success of a real estate crowdfunding investment often depends on the sponsor or developer managing the property. Before investing, research the sponsor’s track record, experience, and reputation. Make sure they have a solid history of successful real estate projects and are transparent in their communication with investors.

5. Understand the Fees: Like any investment platform, real estate crowdfunding comes with fees. Make sure you understand the fees associated with each investment opportunity, including management fees, performance fees, and any other charges. Factor these fees into your investment calculations to ensure you’re getting a good return on your investment.

6. Stay Informed: The real estate market is constantly evolving, so it’s important to stay informed about market trends, regulations, and other factors that could impact your investments. Keep up with industry news, attend webinars, and network with other real estate investors to stay ahead of the curve.

7. Reinvest Your Earnings: Once you start earning returns on your real estate crowdfunding investments, consider reinvesting those earnings to further grow your portfolio. Reinvesting your earnings can help compound your returns over time and accelerate your wealth-building goals.

8. Seek Professional Advice: If you’re new to real estate crowdfunding or unsure about where to start, consider seeking advice from a financial advisor or real estate professional. They can help you navigate the world of real estate crowdfunding, assess your risk tolerance, and develop a personalized investment strategy that aligns with your goals.

By following these tips, you can unlock your wealth and maximize your investment success with real estate crowdfunding. Remember, successful investing takes time, patience, and a willingness to learn. With the right approach and mindset, real estate crowdfunding can be a powerful tool for building wealth and achieving your financial goals.

Skyrocket Your Investments with Crowdfunded Real Estate

Real estate crowdfunding has become a popular way for individuals to invest in the real estate market without the hassle of purchasing a property outright. Through crowdfunding platforms, investors can pool their money together to invest in a variety of real estate projects, from residential properties to commercial developments. This innovative form of investing offers a number of benefits for those looking to maximize their investment success.

One of the key advantages of real estate crowdfunding is the ability to diversify your investment portfolio. By investing in multiple properties across different locations and asset classes, you can spread out your risk and increase your chances of a successful return. This diversification also allows you to take advantage of different market trends and capitalize on opportunities in various regions.

Another benefit of real estate crowdfunding is the accessibility it provides to investors. With crowdfunding platforms, you can invest in real estate with relatively low minimum investment amounts, making it easier for individuals to get started in the market. This democratization of real estate investing opens up opportunities for a wider range of investors, including those who may not have the capital to purchase a property on their own.

In addition to diversification and accessibility, real estate crowdfunding also offers investors the potential for high returns. By investing in projects with strong growth potential and rental income streams, you can generate passive income and build wealth over time. With the right investment strategy and due diligence, you can maximize your returns and achieve financial success through real estate crowdfunding.

To skyrocket your investments with crowdfunded real estate, it’s important to do your research and choose the right platforms and projects to invest in. Look for crowdfunding platforms with a track record of success and a diverse range of investment opportunities. Consider the location and type of property, as well as the potential for growth and rental income.

When selecting projects to invest in, pay attention to the due diligence process and the track record of the project sponsor. Make sure the project is backed by a reputable developer with a proven track record of success in the real estate market. Additionally, consider the risks and rewards of each investment opportunity and assess whether it aligns with your investment goals and risk tolerance.

In conclusion, real estate crowdfunding offers investors a unique opportunity to maximize their investment success and achieve financial growth. By diversifying your portfolio, accessing new investment opportunities, and focusing on high-return projects, you can skyrocket your investments with crowdfunded real estate. With the right strategy and due diligence, you can build wealth and secure your financial future through the power of real estate crowdfunding.

How to Leverage Real Estate Crowdfunding for Investment Success