Get Started: Mastering the Fundamentals of Investing

When it comes to investing, it can often feel overwhelming and intimidating, especially for beginners. However, mastering the fundamentals of investing is the key to successful investing. By understanding the basics, you can make informed decisions, mitigate risks, and ultimately grow your wealth.

One of the first steps to mastering the fundamentals of investing is to understand the concept of compound interest. This is the idea that your money can grow exponentially over time, as the interest you earn on your initial investment also earns interest. By starting early and letting your money compound over time, you can significantly increase your wealth.

Another important fundamental of investing is diversification. This means spreading your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk. By diversifying your portfolio, you can protect yourself from market fluctuations and potentially increase your returns.

Risk management is also a crucial aspect of investing. Understanding your risk tolerance and incorporating strategies to mitigate risk, such as setting stop-loss orders or investing in index funds, can help you navigate the ups and downs of the market with confidence.

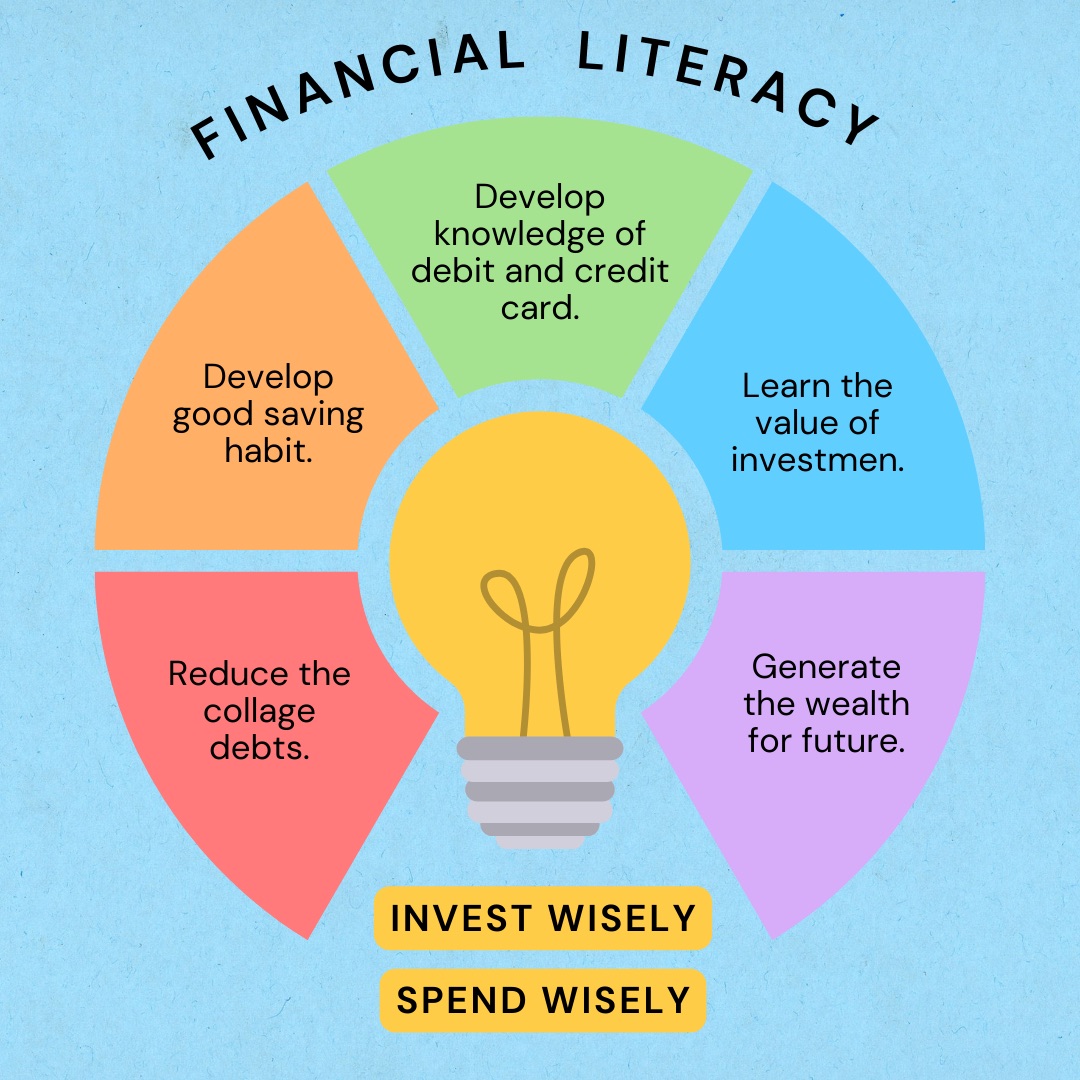

Image Source: ineducationonline.org

Furthermore, it’s essential to have a clear investment strategy and goals. Whether you’re investing for retirement, a major purchase, or simply to grow your wealth, having a plan in place can help you stay focused and disciplined in your investment decisions.

In addition to these fundamentals, it’s important to stay informed and educated about the market. Keeping up with financial news, reading investment books, and learning from experienced investors can help you make smart choices and adapt to changing market conditions.

Finally, consistency is key when it comes to successful investing. By regularly contributing to your investments, staying disciplined with your strategy, and avoiding emotional decisions based on market fluctuations, you can steadily grow your wealth over time.

In conclusion, mastering the fundamentals of investing is essential for success in the world of finance. By understanding concepts like compound interest, diversification, risk management, and having a clear investment strategy, you can make informed decisions and grow your wealth over time. Remember to stay informed, stay disciplined, and stay consistent in your investing journey.

Unlocking Success: The Power of Understanding the Basics

Investing can seem like a daunting task for many people, especially those who are new to the world of finance. With so many different options and strategies available, it’s easy to feel overwhelmed and unsure of where to start. However, the key to successful investing lies in understanding the basics.

When it comes to investing, knowledge is power. By taking the time to educate yourself on the fundamentals of investing, you can make informed decisions that will help you grow your wealth over time. Whether you’re looking to invest in stocks, bonds, real estate, or other assets, having a solid understanding of the basics is essential.

One of the first things to understand when it comes to investing is the concept of risk and return. In general, the higher the potential return on an investment, the higher the risk involved. This means that while investing in stocks may offer the potential for high returns, it also comes with a greater level of risk compared to investing in bonds or other more conservative assets.

Another key concept to grasp is the importance of diversification. Diversifying your investment portfolio means spreading your money across a variety of different assets and asset classes. This can help reduce risk and protect your investments from market fluctuations. By diversifying, you can ensure that you’re not overly exposed to any one particular investment, which can help protect your wealth in the long run.

Understanding the basics of investing also involves knowing how to set and achieve your financial goals. Whether you’re saving for retirement, a new home, or your child’s education, having clear goals in mind can help guide your investment decisions. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can create a roadmap for your investing journey and track your progress along the way.

In addition to setting goals, it’s important to establish a solid investment strategy. This involves determining your risk tolerance, time horizon, and investment objectives. Your risk tolerance refers to how comfortable you are with taking on risk in your investments, while your time horizon is the length of time you plan to hold your investments. Your investment objectives should align with your financial goals and overall investment strategy.

Once you have a solid understanding of the basics of investing, you can begin to explore different investment options and strategies. Whether you prefer to invest in individual stocks, mutual funds, exchange-traded funds (ETFs), or other assets, it’s important to choose investments that align with your risk tolerance, time horizon, and financial goals.

Another important aspect of successful investing is staying informed and up to date on market trends and economic news. By staying informed, you can make informed decisions about when to buy, sell, or hold your investments. This can help you take advantage of opportunities in the market and avoid potential pitfalls that could negatively impact your portfolio.

In conclusion, understanding the basics of investing is crucial to success in the world of finance. By educating yourself on key concepts such as risk and return, diversification, goal setting, and investment strategy, you can make informed decisions that will help you grow your wealth over time. With the right knowledge and a solid plan in place, you can unlock the power of investing and achieve your financial goals.

The Importance of Financial Literacy in Successful Investing